Bank lending in Japan grew 6.1% last January to $ 5.6 trillion

Bayanalysis

- Total bank lending in Japan rose 6.1 percent in January 2021 compared to the same month over the past year 2020, and is slower than the 6.2 percent rise in December 2020, according to the BoJ.

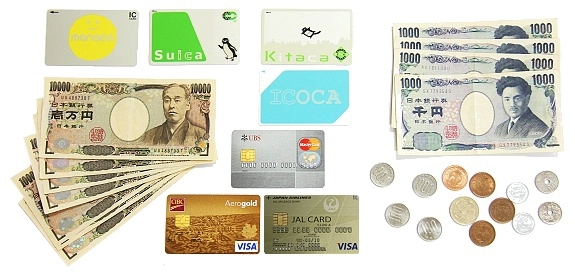

The outstanding loans held by the four main categories of banks in the country, including "Shinkin" or credit unions, amounted to 584.967 trillion yen, equivalent to about $ 5.56 trillion (at a dollar = 102.54 yen).

The highest rate of bank lending in Japan was in August 2020, which was 6.7% at that time, while the largest decline since the Japanese lending data statistics was 5% in October of 2002. The decline prevailed throughout the first years of the new millennium, specifically From 2001 to the end of 2005, before declining again from December 2009 to September 2011.

In Japan, the term bank borrowing refers to the rates of change, whether negative or positive, for all loans owed by banks or shinkin banks. The increase in lending indicates an increase in investment and business confidence, which means that the Japanese banking sector has regained some of the weakness that it has suffered during the last period affected by Corona.

No comments: