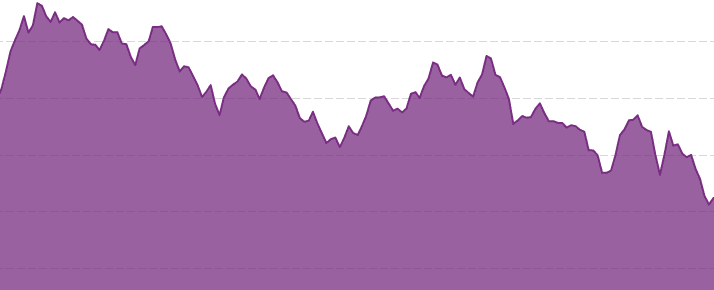

The yield of French bonds

Bayanalysis

- The return on French bonds for a period of a month was negative 0.64% last Friday, and the return on French 3-month bonds was negative 0.63% on Friday, January 29, according to the yield rates of interbank bonds outside the stock market due to the maturity of government bonds.

The French 6-month bond yield was minus 0.58 percent on Friday, January 29th, according to OTC interbank quotes for the maturity of government bonds.

The French one-year bond yielded negative 0.62 percent on Friday, January 29th, according to the OTC interbank yield rates for the maturity of these government bonds.

The yield on French two-year bonds was minus 0.70%, and for 3 years, it was minus 0.59%.

And the bond yields in France came to 5, 6, 7, 10, 20, as follows, "all negative" 0.60, 0.58, 0.46, 0.27, zero, per cent.

Thank you for your response and I hope you will always like bayanalysis content

ReplyDeleteHello there! This is kind of off topic but

ReplyDeleteI need some advice from an established blog. Is it very hard to set up your own blog?

I'm not very techincal but I can figure things out pretty quick.

I'm thinking about making my own but I'm not sure where to

start. Do you have any ideas or suggestions? Thanks

No, it is not difficult to create a blog or a complete website, but it needs some time and effort, especially in the small details, which in all require a great effort

DeleteI'm really enjoying the design and layout of your blog.

ReplyDeleteIt's a very easy on the eyes which makes it much more enjoyable for me to come here

and visit more often. Did you hire out a designer to create your theme?

Superb work!

This is something that makes me happy, and crowns my efforts.

DeleteNo I did not hire anyone, I set up my entire site from programming, design, archiving, writing, analysis and ideas, all the things I did.

Heya i am for the first time here. I found this board and I

ReplyDeletefind It truly useful & it helped me out a lot. I hope to give something back and help

others like you aided me.